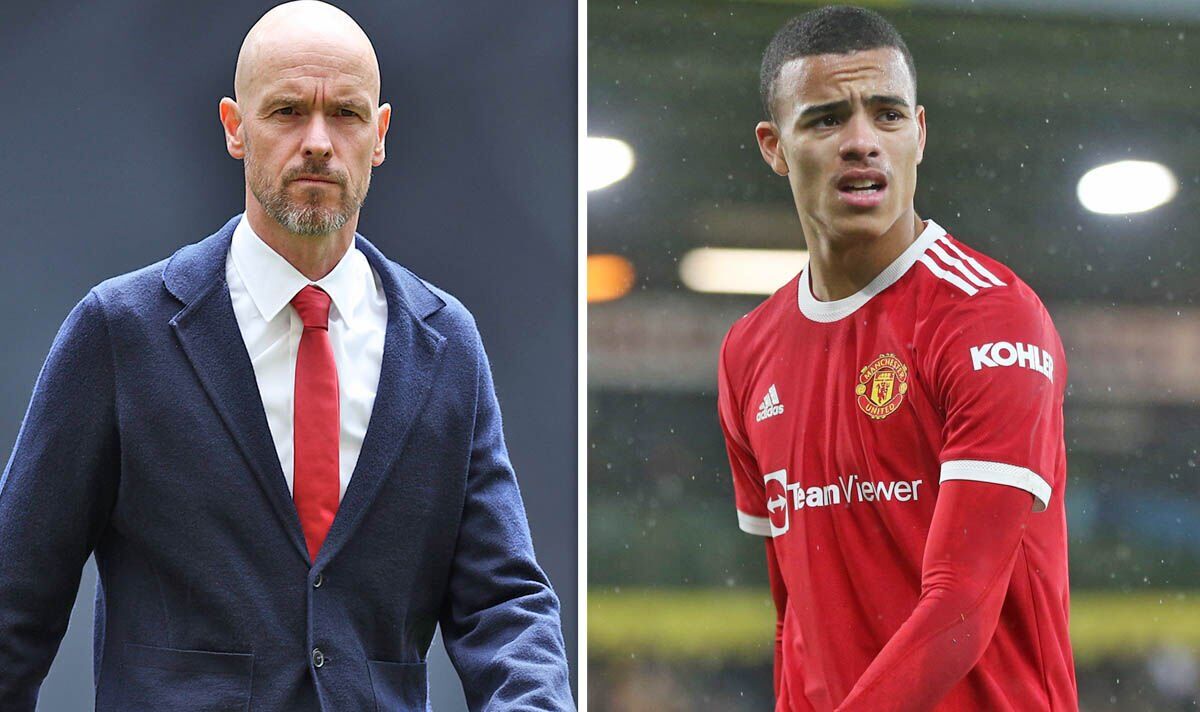

Mason Greenwood is to leave Manchester United by mutual consent after the club completed an internal investigation into his behaviour.

United must now decide whether to sell the player this summer, or loan him out to another club with a view to potentially placing him on the transfer list the following summer.

Greenwood has been suspended by United since his January 2022 arrest on suspicion of rape and assault. He was subsequently charged with attempted rape, engaging in controlling and coercive behaviour and assault occasioning actual bodily harm in October.

Then, in February, the charges were discontinued by the Crown Prosecution Service. In a statement, the CPS noted that the combination of the withdrawal of key witnesses, and new material that came to light, meant there was ‘no longer a realistic prospect of conviction’.

Greenwood still has two years left on his contract, which he signed in February 2021.

The 21-year-old has still been paid in full by United, and the club will continue to do so until a resolution over his future is found, per ESPN.

SPORTbible spoke to football finance expert Kieran Maguire about the financial and monetary impact that Greenwood’s departure could have on United, depending on the type of departure involved.

Q. What are the primary financial considerations Manchester United would have had to take into account when deciding on Greenwood’s future before settling on the statement released?

Manchester United would focus on the following:

(a) Potential impact on the brand value of the club in terms of what a prospective owner would be willing to pay to buy the company. One would expect that any reservations/concerns that new owners have communicated would have been taken into account in terms of the final decision… assuming there is still a desire to sell the club, which is a separate issue.

(b) Impact on key stakeholders of the club in terms of major commercial partnerships. There could be moral hazard clauses in contracts which would allow the other party to walk away from their contracts, leaving a financial void. This could be a messy and expensive issue if the two parties then disputed the validity of the attempt to walk away from the contract.

Other parties, although of less financial significance to the decision makers, would be staff (both non playing and playing) and fans.

(c) Share price considerations. If key minority shareholders of the shares that are listed on the New York Stock Exchange (NYSE) decided to sell their holdings it could have a negative impact on the traded share price, with potential implications for the sale of the club.

Q. What would the estimated total cost/losses work out at for United if he leaves the club for free?

It would depend on the nature of his leaving. At present he has a contract until 30 June 2025, at an estimated £75,000 a week, so that is the best part of £8 million in wages. If Greenwood was allowed to leave and his contract paid then that would be the maximum potential payout.

In addition there is a sale/loan fee. Given current market conditions, age, nationality and being chosen to play for his country and his history at the club, a sale price in excess of £100 million plus area is easily feasible, but as impaired inventory (as he will be seen by the Glazers/executives) this price is unlikely to be achieved but still could be in eight figures.

Given the extensive criticism that the United senior management have received to date in relation to their handling of the affair, a commitment to pay a proportion of any fee the club do receive to domestic violence charities could be one way of earning back some credibility.

There is also the replacement cost of someone filling the squad gap left by Greenwood. Again this would be in significant tens of millions as a minimum.